ADOPTION AND INHERITANCE

ADOPTION AND INHERITANCE

“My parents have a biological daughter and I, their son, am the only adopted child in the family. My family got into a car accident and my adoptive father has passed away and left no Will for us to inherit his property. Since I am adopted, will I be given a fair share of my father’s property?”

According to Orphan Care Malaysia, Malaysia is home to around 64 thousand orphaned children. Adoption can provide a congenial home to these children. With adoption, there are a number of issues that can be worrying, one of which includes the adopted child’s rights to inheritance.

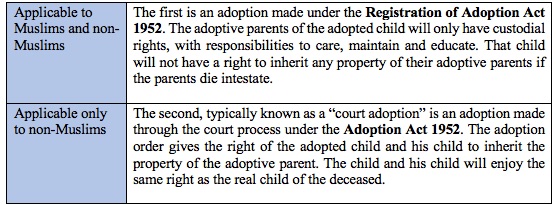

There are only two ways of legally adopting a child in Malaysia.

Conditions to inherit

However, for the children to inherit on intestacy, he must have survived the deceased at the death of the parent even for a second. Let’s take this as an example:

“A son (A) and his father (B) was involved in an accident. A survived B by 5 minutes. A will inherit B’s assets.”

In a slightly different situation, there may be cases where it is unascertainable on who survived the other. This applies when two or more persons from a family dies simultaneously in an accident. Here, we will look at Section 2 of the Presumption of Survivorship Act 1950 whereby the death is presumed to have occurred in order of seniority i.e. the younger is deemed to have survived the elder. Let’s take this as an example:

“A and B was involved in a plane crash. Nobody could ascertain who died first. The law will presume that the father died first and the son survived him. Therefore, A will still be entitled to inherit B’s assets as he is presumed to survive B. Since A also died in the plane crash, A’s portion from B’s property will be included in his assets and would be succeeded by A’s legal heirs.”

Distribution

Section 6 of the Distribution Act 1958 provides for the methods of distribution of an intestate’s estate. Distribution will only take place once payment of debts and other liabilities is duly made. You may view the distribution table in my previous article at https://koha.digital/is-it-necessary-to-have-a-will/.

Conclusion

To answer back the question, parents must ensure that adoption be made in accordance with the provisions under Adoption Act 1952 in order to qualify the adopted child for inheritance. Once the Court issues the adoption order, the adopted child will be considered as the child of the adopters as if he was born in lawful wedlock and therefore all distributions will be made in accordance with Section 6 of the Distribution Act 1958.